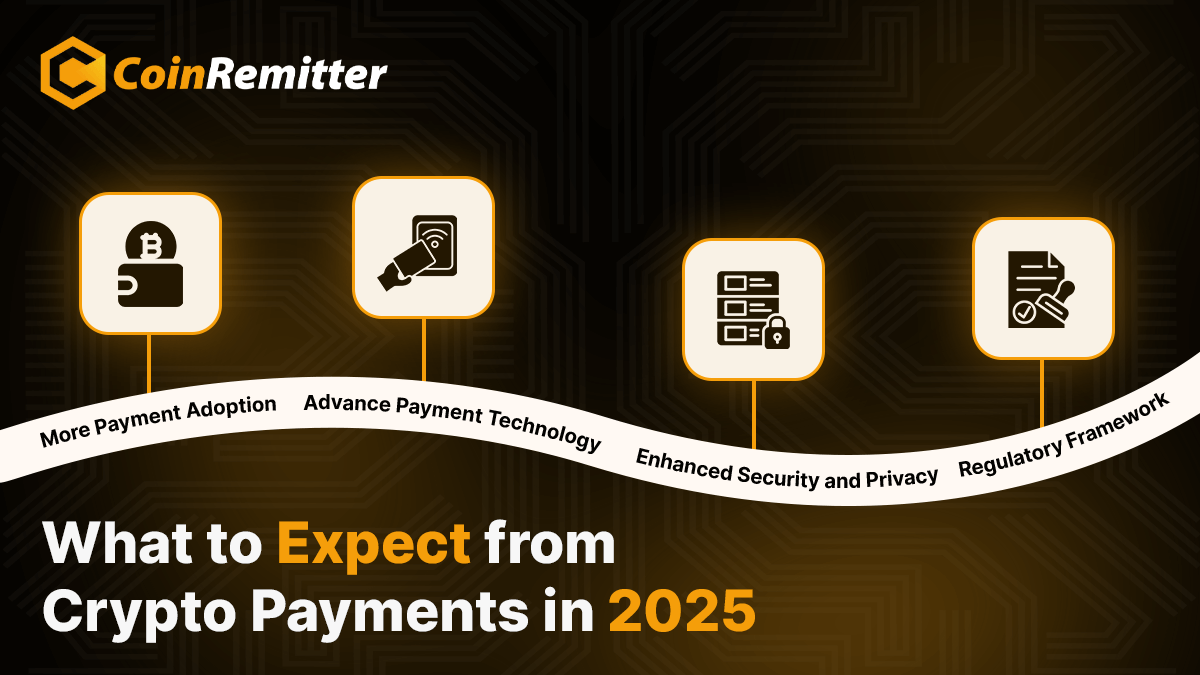

What to Expect from Crypto Payments in 2025

The crypto revolution has significantly impacted the financial landscape. Considering 2024, the future of crypto payments seems promising. As we are heading towards 2025, let’s see what we can expect from crypto payments throughout the year.

1. Increased Crypto Payment Adoption

Around 562 individuals will be owning any form of cryptocurrency by the end of 2024. Some of them may look to spend or use them somewhere. So, we can expect that the number of customers who prefer to pay in crypto may rise in 2025.

This may convince online retailers to expand their payment options by adding crypto payments to their checkout processes. Retailers accepting crypto payments are expected to rise by 30%. Coinremitter also witnessed over 5000 registrations during 2024, reflecting the projected rise to be true in the future.

Some major international brands and SMBs (small and medium-sized businesses) may also integrate a crypto payment gateway into their existing systems to pay lower transaction fees and attract tech-savvy and crypto-oriented customers.

2. Advancements in Payment Technologies

Layer-2 solutions may bring more advancements to the crypto payment system in 2025. More dApps and protocols may migrate to Layer 2 solutions to benefit from faster transaction speeds and improved user experience. A wider range of Layer 2 solutions, including ZK-rollups, optimistic rollups, and state channels, may emerge and offer unique advantages that cater to different use cases.

We can expect interoperability between two or more networks, which may expand the ecosystem and increase the liquidity of involved networks. Also, CBDCs will likely gain traction, which may influence the future of digital payments and challenge the dominance of traditional fiat currencies.

3. Enhanced Security and Privacy

Robust security measures, such as zero-knowledge proofs and biometric authentication, will be implemented to safeguard user funds and personal information. Privacy-focused cryptocurrencies will gain popularity, allowing users to conduct transactions with greater anonymity.

The world may lean towards more secure and privacy-focused solutions in 2025, which may convince business owners to accept crypto payments. who are worried about privacy and security. Thanks to the influence created by no KYC crypto payment gateways like Coinremitter.

4. Global Regulatory Framework

Trump’s victory and the US’s crypto admiration have set an example to the world. We can see the nation introducing crypto-friendly regulations. Many other nations have started going liberal for crypto. For example, Russia and Brazil have also proposed Bitcoin reserves to their respective parliaments recently.

This may influence governments from other nations to grow their faith in crypto and develop clearer regulations for the crypto industry, which may provide a more stable and predictable environment for businesses and consumers to make smooth crypto payments. However, international cooperation will be crucial in establishing consistent and friendly regulatory standards to manage and normalize cross-border crypto transactions.

Potential Challenges

- Volatility: Cryptocurrencies are prone to price volatility. Some business owners may fear accepting crypto payments due to decreasing prices or bear runs. However, stablecoins like USDT or USDC can be good crypto options to avoid price volatility.

- Dissimilar Regulations: Crypto regulations across regions may not be equal or similar. An uneven approach may not always favor global adoption and cross-border transactions.

- Cybersecurity Risks: With the growing crypto adoption, cyber attackers may target exchanges, wallets, and payment platforms more aggressively. Relying on a cryptocurrency payment platform like Coinremitter may help you stay away from such cyberattacks with its security features.

- Consumer Skepticism: Misinformation and a lack of understanding about cryptocurrencies may affect their worldwide adoption. Experts and businesses that accept crypto payments must keep consumers educated to avoid skepticism.

Conclusion

The future of crypto payments can be promising if the expectations mentioned above come true, at least by the end of 2025. However, the world still needs to overcome challenges like volatility, regulatory uncertainty, security concerns, and consumer behavior to unlock its full potential. Consumers that prefer to pay in cryptocurrencies and crypto payment solutions like Coinremitter that make crypto payments look beneficial to business owners, we can expect the normalization of cryptocurrencies as a mode of payment to begin by 2025.

Over 38,000 merchants are using CoinRemitter

Join them now