Know Everything About Bitcoin Halving, Its Impact, and Importance in Brief

Introduction

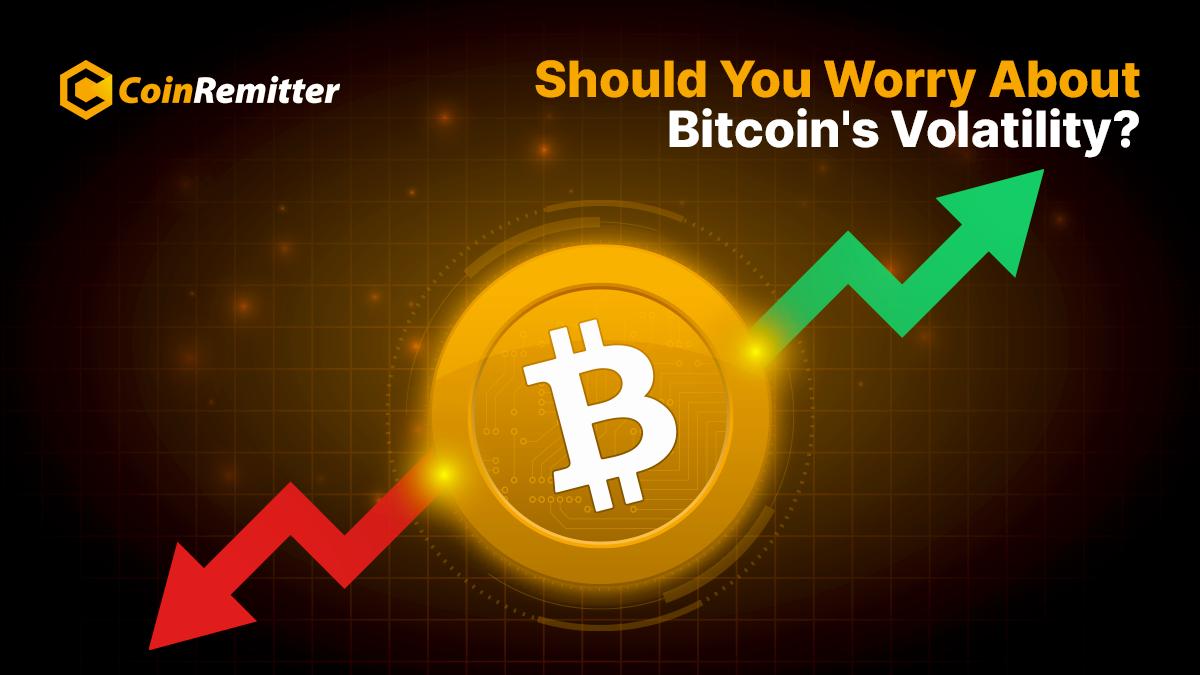

Bitcoin halving is an event, which plays an important role in shaping the Bitcoin network. This process occurs every four years approximately. It focuses on controlling the rate of Bitcoin’s creation and maintains the scarcity of cryptocurrencies in return.

Cryptocurrency miners secure the Bitcoin network by solving complex mathematical problems in the ‘proof-of-work’ process. Miners get newly created Bitcoins and transaction fees as a reward. This event refers to halving mining rewards every 210,000 blocks (approximately four years). For example, miners used to get 50 Bitcoins per block when Bitcoin was created, which was reduced to 25 in 2012 and 12.5 and 6.25 in 2016 and 2020 respectively. The upcoming Bitcoin halving countdown can break the ground in 2024 according to the history as well as some reputed cryptocurrency news sources.

The Impact of Bitcoin Halving

The following factors are impacted by Bitcoin Halving:

- Supply Control

- Scarcity

- Economic Incentives

- Historical Price Movements

Supply Control: Bitcoin halving becomes necessary in controlling its supply. It ensures that Bitcoin remains a deflationary asset by reducing the rate of Bitcoin’s creation, which is simply absent in fiat currencies that can experience monetary inflation.

Scarcity: Decreasing block rewards can increase Bitcoin’s scarcity over time. Similar to some precious objects and elements, improved scarcity contributes significantly to Bitcoin’s store of value, resulting in the retention of its potential purchasing power and its function to be saved, retrieved, and exchanged over time. The higher price of Bitcoin can affect the overall value of Bitcoin holdings used for crypto payments.

Economic Incentives: Crypto halving events contribute to maintaining economic incentives for miners. Because of reduced block rewards, miners are motivated to continue validating the ongoing crypto payments on the blockchain network and securing it for the sake of profitability.

Historical Price Movements: Previously, Bitcoin Halving events gained a lot of attention from the media and legendary investors because of its significant price increase, which impacted the value of Bitcoin and its use in crypto payments. However, historical performances aren’t indicative of future performances, Bitcoin Halving events can leave a speculative impact on the cryptocurrency market.

The Importance of Bitcoin Halving

Bitcoin Halving is important for several reasons, which are as follows:

- Economic Stability

- Long-Term Viability

- Investor Attraction

Economic Stability: Bitcoin halving events cause a predictable supply model, which becomes effective in stabilizing Bitcoin’s value and prevents hyperinflation.

Long-term Viability: Halving ensures the sustainability and security of the network, which causes Bitcoin’s long-term viability in the cryptocurrency market.

Investor Attraction: The fluctuation in the demand-supply ratio (probably lower demand compared to higher supply) draws investors’ attraction, resulting in cryptocurrency investors getting attracted towards Bitcoin, which often affects Bitcoin’s price dynamic.

Conclusion

Bitcoin Halving is an important event in Bitcoin monetary policy. Due to its impact on supply control, scarcity, economic incentives, and historical price movements, it is standing right in its place, Bitcoin Halving is widely anticipated. It supports Bitcoin’s role as a digital asset as well as strengthens its security as well as position as a noteworthy currency in the fintech world.

Over 38,000 merchants are using CoinRemitter

Join them now